PNN – As the West celebrated Christmas, chronic inflation, mounting debt, and job insecurity have left millions of American and European households facing the New Year with anxiety.

With Christmas (December 25th) now past and only a few days left until Thursday, January 1st, 2026, signs of economic pressure in Western societies are becoming more apparent than ever. The quick return to daily life after the holidays means many households must again face accumulated expenses, short-term debts, and uncertainty about their livelihood prospects—conditions that prevent the end of the year from being a period of calm and hope.

This short gap between the end of the holiday celebrations and the start of the New Year, instead of symbolizing renewal, has become a moment revealing structural economic pressures. Persistent inflation, eroded purchasing power, and labor market fragility have made the transition from Christmas to the New Year for a significant portion of Western citizens not a step toward a brighter future, but an entry into a period of economic doubt and caution.

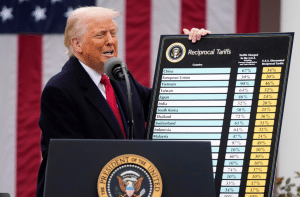

Christmas in America is overshadowed by inflation, unemployment, and Trump’s tariff policies.

The United States of America, which calls itself the world’s largest economy, has experienced a different Christmas this year. According to the latest report from The Conference Board, the Consumer Confidence Index in the U.S. fell by 3.8 points to 89.1 in December 2025, down from 92.9 in November. This drop in consumer confidence has reached its lowest level since April, close to the period when Donald Trump imposed extensive import tariffs against America’s trading partners.

Furthermore, the index measuring Americans’ short-term expectations regarding income, business conditions, and the labor market remains at 70.7; a level that has stayed below 80 for eleven consecutive months and, according to experts, could be a sign of an impending recession.

The primary concern for Americans remains inflation and rising prices. Although the inflation rate decreased to 2.7% in November, the Consumer Price Index has increased by 26% over the past six years; in other words, price growth has been twice the optimal pace set by the Federal Reserve.

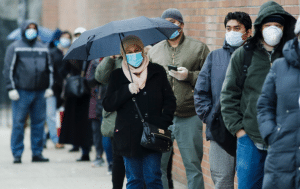

The labor market situation is also concerning. The Trump administration announced that the U.S. economy created only 64,000 jobs in November, while it lost 105,000 jobs in October. The unemployment rate rose to 4.6% in November, its highest level since 2021.

From March until now, average job creation has fallen to 35,000 per month, while this figure was 71,000 jobs in the 12-month period ending in March. The US labor market is caught in a state of “low hiring, low firing” as businesses act cautiously due to the uncertainty stemming from Trump’s tariffs and the lingering effects of high interest rates.

Trump’s trade tariffs have also become a key factor in the economic pressure on households. The 19% tariff on Malaysia and heavier tariffs on Southeast Asian countries have increased the price of Christmas gifts and consumer goods. Toy and consumer goods manufacturers have been forced to spend a significant portion of their time adapting their businesses to the new tariffs, which increased both production and transportation costs and caused delays in product delivery.

A Politico Institute poll shows that 65% of American households say the cost of living has gotten worse or much worse in the past year. Consumers’ assessment of the current economic situation has plummeted by 9.5 points to 116.8. The December survey revealed that respondents’ views on their family’s current financial situation have, for the first time in nearly four years, fallen into negative territory.

These statistics point to one reality: this year’s Christmas and New Year, for millions of Americans, are not a celebration of abundance but a reminder of economic constraints and future anxieties.

A harsh winter of livelihood in Europe; high inflation, mounting debt, zero growth

Across the Atlantic, the state of living in Europe is not much different from America, with signs of economic pressure visible simultaneously in many countries.

In the UK, the latest survey by the YouGov Institute for the StepChange charity reveals that more than a quarter of adults, approximately 14.3 million people, say they have struggled to afford Christmas expenses this year; this proportion rises to nearly one-third among parents with children at home. More concerning is that one-twelfth of this group have had to resort to loans or credit cards to cover costs, and of those, about one-fifth anticipate it will take over a year to repay their Christmas debts.

Data from the Bank of England paints a similar picture. In October alone, approximately £0.6 billion was added to households’ net borrowing from credit cards. According to UK Finance statistics, outstanding credit card debt has grown over the past year, with nearly half of this debt incurring interest. Simultaneously, long queues at food banks have become one of the most tangible signs of this crisis.

The Trussell Trust charity has warned that in the coming winter, on average, one emergency food parcel will be distributed every 10 seconds. The charity reported that last winter, between December and February, around 740,000 emergency food parcels were distributed, of which over 266,000 were for children—a figure that underscores the deepening pressure on the most vulnerable groups.

Inflation remains one of the primary drivers of these ongoing pressures in the UK. Annual inflation in November 2025 reached 3.2%, which, although the lowest level in eight months, remains significantly above the Bank of England’s 2% target. Service sector inflation, recorded at 4.4%, is seen by policymakers as an indicator of persistent price pressures.

Alongside these issues, widespread disruptions in the UK’s transportation infrastructure—from ports and airports to the rail network during the Christmas period—have once again highlighted the structural decay in this sector. The cost to restore deteriorated roads in England and Wales is estimated to be around £17 billion.

These pressures have also spread to the labor market and economic growth. The UK unemployment rate for the period August to October 2025 rose to 5.1%, the highest level since 2021, with the number of unemployed reaching around 1.8 million. Concurrently, the country’s economic growth contracted by 0.1% in the three months leading to October, marking the first decline in GDP since December 2023.

However, the overall picture in Europe is not confined to the UK. At the European Union level, according to Eurostat data, approximately 21% of the population is at risk of poverty or social exclusion; a figure that is significantly higher in some countries. Bulgaria, Romania, and Greece have recorded the highest poverty rates, while in France; the poverty rate reached 15.4% in 2023, nearing its highest level since the 1990s. Even in Germany, the traditional engine of the European economy, the poverty rate has reached 21.1%, slightly above the European Union average.

This collection of data indicates that Europe, on the threshold of the New Year, is facing a combination of persistent inflation, mounting debt, and near-zero economic growth—a situation that will turn the coming winter into a difficult period for the livelihood of a significant portion of the continent’s citizens.

Roots and Prospects: Why has the West reached this state?

The current crisis in the West is rooted in structural factors and economic policies of recent decades; chronic inflation, which began during the COVID-19 pandemic, has still not been fully contained. In the United States, inflation peaked at a 40-year high of 9.1% in October 2022, and in the UK, it reached 11.1% in October 2022, the highest level in 41 years. Although the inflation rate has declined, absolute prices remain significantly higher than pre-pandemic levels, and a falling inflation rate does not mean falling prices, but merely a slower rate of price increases.

Alongside these factors, the war in Ukraine has become a key variable exacerbating economic pressure in the West. Over the past three years, the United States and European countries have allocated hundreds of billions of dollars in financial, military, and arms aid to Ukraine; expenditures that have directly added to budget deficits and forced governments to increase borrowing or cut social spending. Simultaneously, the war’s consequences for the energy market, particularly in Europe, have led to a sustained increase in the price of electricity, gas, and fuel, raising production and living costs.

The Gaza war and the extensive financial, military, and arms support from the United States and some European countries for the Zionist regime have also imposed a new layer of pressure on Western economies. Increased military spending, heightened geopolitical uncertainty, and disruptions to trade and shipping routes, especially in the Red Sea and Eastern Mediterranean, have led to rising costs for transportation, insurance, and imports, with its inflationary effects gradually transferring to domestic economies.

In addition, the tariff policies of Donald Trump have also fueled this crisis. Widespread tariffs on imports from China, Malaysia, Vietnam, and other Southeast Asian countries have led to increased costs of goods and disruptions in the supply chain. These tariffs have not only raised prices but have also intensified economic uncertainty, causing businesses to hesitate in investing and hiring.

The deterioration of infrastructure is another serious challenge. In the UK, the House of Commons Public Accounts Committee has described the state of the roads as a national disgrace, warning that scattered and reactive repairs are effectively wasting public money in an inefficient manner. The rail network is also in poor condition; last year, for every 100 trains scheduled to run, approximately 5 were either canceled altogether or stopped mid-route.

The situation on continental Europe is not much better. Germany, considered the economic engine of Europe, faces a structural crisis. According to a report by the German Economic Institute, 55,000 jobs have been lost in the automotive and parts manufacturing industries since 2019, and it is projected that nearly 90,000 more jobs will be eliminated by 2030. Germany’s exports to the United States fell by approximately 7.4% in the first nine months of 2025, and its trade deficit with China has reached a record €87 billion.

In its latest report, the International Monetary Fund has called for a “deep reduction in the European model and social contract” to compensate for budget deficits arising from increased military spending and state aid to banks. The Fund predicts economic growth in the Eurozone in 2025 and 2026 to be 0.8% and 1.2% respectively, which is a 0.2% reduction from its January forecasts.

The outlook is not particularly bright either. Many economists are concerned about the possibility of a recession in 2026. The US Federal Reserve, at its latest meeting, has adopted a more cautious policy, indicating that the reduction in interest rates will continue at a slower pace. The short-term expectations index in the US, which has remained below 80 for the eleventh consecutive month, is a sign of deep concern about the economic future.

The social repercussions of this crisis are also profound. Reduced purchasing power, increased household debt, growing demand for emergency food aid, and declining public confidence in the future all indicate that the West is facing a structural and long-term crisis, not a short-term recession. Brexit in the UK has also exacerbated these problems, with stricter border controls causing chain delays in the movement of goods and passengers.

Under these circumstances, while governments continue to deliver hopeful messages, the reality of daily life for millions of households in the West tells a different story—a story in which Christmas and the New Year of 2026 are no longer a celebration of abundance and hope, but a reminder of the deep gap between rhetoric and reality.