PNN – In the first term of his presidency, Donald Trump pursued economic policies that, although he thought were in the interest of the American people and workers, brought tension to the international economy. Now the question is raised that in the next four years, when he will be in charge of the White House for the second time, will the economic conditions of the world still witness the conditions of “lack of confidence and volatility”?

Donald Trump was the President of the United States after Barack Obama in the first term of his presidency from January 20, 2017 to January 20, 2021. It had wide consequences in different political, economic and social dimensions, and in this article, we try to examine the effects of this presence on the international economy.

What is Trumponomics?

Trumponomics refers to the principles and economic policies that Trump pursued during his former presidency in an effort to strengthen the economy and increase jobs. Tax cuts, aggressive trade policies and deregulation were some of the main aspects of Trumponomics.

The impact of Donald Trump on the economy

Trump’s economic policies during the first term of his presidency were mostly characterized by tax cuts, trade war and tariffs, deregulation and immigration restrictions.

The Tax Cuts and Jobs Act (TCJA), one of the most well-known aspects of the Trump administration’s economic plan, cut corporate and individual tax rates to give American companies a competitive advantage at home and abroad. Of course, the period of this law and many cases arising from it will expire in 2025, which is likely to be extended or strengthened by Trump in the second term. Meanwhile, Trump’s tariffs on thousands of products, especially his trade war with China, have also become a major part of his economic legacy. Trump’s deregulatory policies notably included rolling back environmental laws, including those governing clean air and water.

Donald Trump’s presidency had a significant impact on the economy because of his administration’s policies and the conditions he inherited. Some experts in the international economy say that Trump’s economic policies have had several effects, such as the fact that it caused the country to re-experience the strong economy before the Corona epidemic; It created many jobs in the United States and reduced the unemployment rate in this country and removed unnecessary and burdensome regulations for the economic growth and trade of this country. In this way, with deregulation, it increased the competitive advantage of American companies in the world. However, there were challenges during Trump’s presidency, such as an economic recession in 2019, a disease epidemic in 2020, an increase in annual budget deficits, and disputes over trade wars and tariffs.

What is the most important indicator of a strong economy?

GDP is the main indicator used to measure the economic performance of a country. This index shows the total value of goods and services that an economy is producing and tells with statistics whether this value is increasing or decreasing and at what rate. Employment figures such as job creation and unemployment rate, consumer spending, inflation, home sales and retail sales are other important economic indicators.

Comparing Trump’s economy with the previous administration

This comparison provides insights into the causes of economic growth and key indicators related to it in the first term of Trump’s presidency. Trump and his administration claimed significant economic success during their presidency, including a booming economy before the shutdown and recession caused by the coronavirus pandemic. Of course, Trump’s critics say he is taking Obama’s economic successes to his name because many of the economic improvements he is referring to were inherited from the administration of former President Barack Obama.

From the perspective of Trump’s opponents, unemployment, job growth, and gross domestic product (GDP) growth all changed direction after a great recession under the guidance and leadership of Obama, and these economic aspects were the key to economic transformations with Trump taking office until the beginning of the year 2020 continued to grow.

Economic challenges of the Trump era

During the first term of the presidency, Trump faced many challenges and controversies, the most important of which are as follows:

Corona epidemic

The corona epidemic was so important that it led to the global economic recession; a recession that some of its effects are still felt after years. Initially, real GDP was 9% below its level at the beginning of the recession. Employment fell by 1.4 million jobs in March 2020 and 20.5 million jobs in April 2020.

Budget deficit

The simultaneous implementation of two laws “reducing taxes” and “increasing defense spending” caused an increase in the budget deficit during Trump’s presidency, so that the fiscal year 2018 faced a deficit of 779 billion dollars, which increased to 984 billion dollars in 2019 and in 2018, 2020 reached more than one trillion dollars.

Trade wars and tariffs

Trump’s first-term trade policies included imposing tariffs on trading partners such as Canada, China, Mexico, and the European Union. Economic experts believe that US tariff policies have an impact on the growth of the global economy.

For this reason, Trump used this tool to try to improve the economic conditions of the United States, and in fact, the imposition of tariffs on the goods and services of rival countries of the United States benefited American workers. Because it provided a pressure lever to Washington so that it can have the upper hand in any kind of international or international trade agreement and impose the superiority of American economic security on the world. For this reason, the Trump administration imposed heavy tariffs on thousands of products and goods imported to America, including washing machines, solar panels, and steel.

However, according to the economic experts of England, India, China, the European Union, Mexico and Canada, at the same time as Trump re-enters the White House, they should wait for new and heavy tariffs to be imposed by the United States.

Increase in national debt

An analysis by the Responsible Federal Budget Committee found that President Trump added $8.4 trillion to the national debt during his presidency.

Summary

Although a president affects the economy through legislation and politics, it must be said that no president alone can be responsible for the overall state of the economy, and his victories and failures do not depend entirely on him. Many factors contribute to the strong or weak performance of an economy; In the US, it depends on the actions of the Federal Reserve, major events such as war or an epidemic, and more.

However, examining the economic performance of the United States in each term of the American presidency is a common topic in the media and academic circles and business-economic gatherings. Some American economists say that Trump was the inheritor of the economy of Covid-19 in 2020; when the unemployment rate increased sharply and the stock market fell, and many of Trump’s economic policies and programs were registered and implemented in response to the Corona pandemic.

Of course, Trump will enter the White House in a completely changed situation in the second term, which can play an effective role in the implementation of new policies.

- Trump’s new economic promises

However, Trump’s economic policies and actions will be under the microscope in the second term of the presidency because some of his campaign promises in 2016 will come back. In the second round of election campaigns and contests in 2024, he promised the people of this country that inflation, taxes, and energy and electricity costs will be reduced by half, and the American people will be rich like in the first round of his presidency. But surely other countries will have to pay some of the costs of his decisions for “America First” and “the American worker first.”

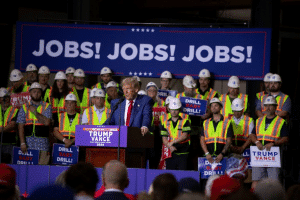

He also announced a broad economic agenda for the second term, which includes drilling for new and more energy sources, bringing immigrants home, strengthening Social Security and health care, and keeping the United States out of World War III.

This time, Trump is calling for broader and higher tariffs on imported goods and keeping previous tax cuts, some of which expire in 2025, as well as some new ones, such as further corporate tax cuts. This reduction would reduce revenues to the government and potentially increase the national debt unless compensated in some way.

- Implications of the Trump administration for the global economy

According to the report of the London Business School, Trump’s return to the White House in January 2025 has increased the level of economic uncertainty in 2025.

One of the many challenges of analyzing the impact of Trump’s second term is that his policies, as well as the administration staff who will implement them, are still being formulated. Therefore, at this point in time there are only broad outlines of what his alleged policies might entail for the United States and the rest of the world. However, many of them have been largely influenced by the economic policies of the first term of his presidency.

The important point is that one of the economic issues that will undoubtedly be considered in the second term of the Trump administration will be the imposition of tariffs. Trump said that he is seeking to apply nationwide tariffs of up to 20% on all goods imported to the United States. In addition, tariffs may be as high as 60 percent for China and 200 percent for Mexico. Germany and Vietnam are also among the countries that are more interested in additional tariffs because the trade surplus of their bilateral relations with Washington has not been in the interest of the United States.

Another important point is that the International Monetary Fund previously described global growth as weak and announced that most countries have weak growth; so a further blow to global trade would certainly risk lowering the GDP growth forecast of 3.2 percent for next year.

Another point is that Trump’s other policy of deporting illegal immigrants is very challenging, because this decision will also affect the supply of labor at the international level.

Central banks don’t like to reverse course because they have to manage inflationary expectations; so the Fed and other central banks are likely to be cautious. It may mean that they will keep rates at their current capped levels for longer. In fact, monetary policy tends to react to fiscal policy. So seeing what the Trump administration and the Republican-controlled Congress do in 2025 will be important factors in how quickly US interest rates go around the world because that rate and the state of the dollar in the global economy will be affected.

Digital currencies and the government’s new advisory department to increase efficiency as well as deregulation, especially in financial markets, are all issues that will completely affect the formal economy and the blockchain-based economy when the new Trump administration takes office next year.