PNN – Reputable international media describe the resilience of the Iranian economy against sanctions as “unparalleled.”

According to the report of Pakistan News Network, the history of world political economy in the last century has rarely seen an example of a country being subjected to the most severe, complex, and intelligent sanctions regime and still remaining afloat. By designing secondary sanctions, closing SWIFT, sanctioning the central bank, and reducing oil exports to zero, the “maximum pressure” strategists in Washington had calculated on paper that the Iranian economy would ultimately suffer a total collapse within 6 months to a year. They were expecting famine, a complete shutdown of power plants, and a paralyzing transportation system.

But today, several years after the start of that full-scale economic war, although people’s tables have shrunk and inflation has cast a shadow over their livelihoods, the “main structure of the economy” has not only not collapsed, but has also shed its skin and been vaccinated in many sectors. The following report examines the phenomenon of the “stunning resilience” of the Iranian economy, citing data from international institutions and confessions from Western media.

In Western academic and media circles, talk of “regime change through economic pressure” has faded. Now the main question for Western analysts is: How did Iran survive?

- The Financial Times and Iran’s “adaptive economy”: The Financial Times, in a series of reports published in 2023 and 2024, has repeatedly pointed out that Iran’s economy has recovered from the initial shock.

- Foreign Affairs: The Failure of America’s Strategy. In an analytical article examining Iran’s macroeconomic indicators, the prestigious publication Foreign Affairs acknowledges that sanctions have only been able to slow growth, but have not been able to destroy the economy.

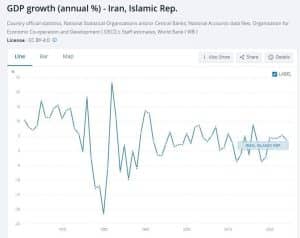

- World Bank: Return to positive growth World Bank data, which is usually published with strictness and conservatism about Iran, shows that the Iranian economy has been able to experience positive economic growth (GDP Growth) consecutively for the past three years.

Although this growth has fluctuated between 3 and 5 percent, the fact that the number is not “negative” is a refutation of the collapse theory. The World Bank confirms in its “Economic Outlook” report that Iran’s service and industrial sectors have been able to recover after the shock of the coronavirus and sanctions.

2) Resilience Dissection: Why didn’t Iran become Venezuela?

Comparing Iran with countries like Venezuela that have buckled under the pressure of sanctions reveals the structural differences in Iran’s economy. International experts cite four main reasons for this unparalleled resistance:

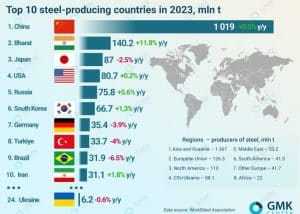

- A) Economic diversification and escaping the oil curse: The biggest achievement of sanctions for Iran was reducing its budget dependence on oil. Before the sanctions, crude oil constituted the bulk of foreign exchange earnings. But today, Iran’s non-oil exports (petrochemicals, steel, food, construction materials) have taken on a significant share of foreign exchange earnings.

Petrochemical Industry: Iran’s petrochemical industry, as the frontline of foreign exchange earnings, has proven itself virtually immune to sanctions by diversifying its products and export markets.

It should be noted that although Iran’s non-oil exports have been accompanied by challenges during the years of sanctions, their trend has never stopped. For example, Iran has been able to have nearly $60 billion in non-oil exports, which is a record low in non-oil exports.

These foreign exchange earnings have been able to form one of the pillars of Iran’s economy in recent years. On the other hand, due to the nature of this export model, which, according to experts, is not very susceptible to sanctions, they have practically neutralized and neutralized international pressures to limit Iran’s oil exports.

- B) Import substitution and revival of national production: The increase in the exchange rate and import restrictions made the import of many goods that were previously supplied from abroad uneconomical or prohibited. This “tariff and sanctions protection” created a golden opportunity for domestic manufacturers. Field reports show that the market share of Iranian brands has increased significantly in the home appliance, clothing, and component manufacturing industries.

- C) Iran’s smart network of sanctions evasion: By creating a complex network of exchange offices, front companies, and a shipping fleet (which the West calls the Ghost Fleet); it was able to break the naval and banking blockade.

- D) Neighborhood diplomacy and looking east: Iran’s strategic turn from the West to the East and its neighbors injected new oxygen into the economy. Membership in the Shanghai Cooperation Organization and the BRICS group, and increased trade with Iraq, Turkey, Russia, and Central Asian countries, opened new markets for Iranian goods, effectively “neutralizing” Western sanctions, as the West is no longer the only actor in the global economy.

3) Foreign debt situation: Iran’s hidden trump card

One of the indicators that has puzzled Western economists is the ratio of external debt to gross domestic product. While many countries in the region and even developed countries are struggling with a foreign debt crisis, Iran has one of the lowest foreign debt ratios in the world due to lack of access to international financial markets and mandatory fiscal discipline.

The International Monetary Fund (IMF) confirms in its database that Iran’s external debt is “close to zero” (on a macro scale), meaning that unlike countries that go bankrupt with a currency shock – because they have to pay installments on dollar loans – Iran’s economy is not vulnerable in this area. This “financial independence” is one of the pillars of resilience that has received less attention.

The end of the age of embargoed weapons

Summarizing international reports and field realities leads us to a clear conclusion that Iran’s economy has passed the “survival” stage and entered the “revival” stage. Iran’s resilience sent an important message to the world: in the 21st century, a country with Iran’s geopolitical characteristics and capabilities can no longer be isolated.