PNN – Although the members of the Persian Gulf Cooperation Council took an important step to overcome the “Dutch disease” and move towards a non-oil economy with a series of reform programs, they are still facing serious challenges to achieve their desired economic goals.

According to the report of Pakistan News Network, in 2022, the Persian Gulf countries were able to record a growth rate of 7.3 percent by overcoming the financial crisis caused by the Corona pandemic, the Ukraine crisis, the fluctuations caused by the OPEC+ agreement and global inflation. Despite the improvement in the economic performance of the countries of the southern Persian Gulf region, it seems that the existence of challenges such as the reduction of oil revenues (due to the OPEC+ agreement) has reduced the economic growth of these countries by 1% in 2023.

Challenges of the global economy

The World Bank has considered the current developments in the oil markets, especially the impact of global market problems on the economy of the countries of the region, among the main causes of the decline in the growth rate of Arab countries in 2023.

This report is consistent with the results of a Reuters survey of economic experts. The results of both reports emphasize that the economy of the Persian Gulf countries is in a downward trend due to the decrease in oil revenues and the decrease in production. In other words, contrary to the propaganda made by the Arab kingdoms regarding diversification in income baskets, it still seems that “black gold” has the first and last word in the economy of the Persian Gulf countries.

In October 2022, the oil alliance “OPEC Plus” announced a daily reduction of two million barrels of oil from November 2022 to September 2023. This decision was implemented voluntarily by member countries such as Saudi Arabia and the United Arab Emirates. Now it seems that this agreement will be extended until the first three months of 2024.

This report states that due to the increase in interest rates in America, Europe and most industrialized countries, the inflation index has increased in these countries and has had a negative impact on economic activities and consumer demand.

For example, the international company “PWC” believes that in 2022, the Persian Gulf countries were able to register a better performance by distancing themselves from geopolitical challenges, the energy crisis and the fluctuations of the western markets. However, the stagnation in one third of the world’s economies and the decrease in the price and production of crude oil have caused the oil-rich countries of the region to record lower economic growth in 2023.

By examining the economies of the governments of the Persian Gulf, the International Monetary Fund has advised them that these countries should be more careful in managing their oil revenues and prevent the increase in current costs. In addition, the prestigious economic institution has asked the governments affected by the Dutch disease to consider the principle of transparency for this year’s budget formulation.

This fund also called for the management of public finances to solve the challenges caused by climate change, global developments in the field of energy and diversification of economic portfolios. Another recommendation of the International Monetary Fund to these countries was to allocate more public resources for renewable energy sources and infrastructure resistant to climate change. Pursuing the reform policy with the aim of making the tax collection system more efficient and rationalizing the wage bill for workers is one of the other recommendations of the International Monetary Fund to the countries of the Persian Gulf Cooperation Council in this report.

Positive economic growth in 2024

Recently, the World Bank claimed in a report that the economy of the member countries of the Persian Gulf Cooperation Council, unlike in 2022, which experienced a growth of 7.3 percent, in 2023, recorded only 1 positive growth observation. Unlike last year, this international organization believes that the economic growth rate of the mentioned countries will increase to an average of 3.6% in 2024. A part of this report states: “Saudi Arabia’s economy will shrink by 0.9% in 2023, but will once again pick up in 2024, recording growth of 4.1%.”

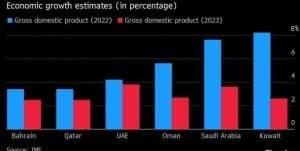

The declining trend of the economic growth of the countries of the Persian Gulf Cooperation Council between 2022 and 2023

The United Arab Emirates will be another successful economy in the Persian Gulf region, which has registered positive growth this year. The economic growth of the UAE in 2023 was 3.4%, but this figure is expected to increase to 3.7% in 2024. According to the forecasts published by this institution related to the Bretton Woods circle, Kuwait will also have significant economic growth in 2024. While Kuwait’s economic growth rate in 2023 was only 0.8%, this figure will reach 2.8% with a significant growth in the new year.

Next, we will discuss the economic growth situation in Qatar, Oman and Bahrain. In 2023, Doha’s economic growth was 2.8 percent, which will reach 2.3 percent in 2024 with a significant drop. The Sultanate of Oman and Bahrain will also experience higher economic growth than in 2023 and will probably experience growth of 2.7% and 3.3% respectively in 2024.

Next, we will discuss the economic growth situation in Qatar, Oman and Bahrain. In 2023, Doha’s economic growth was 2.8 percent, which will reach 2.3 percent in 2024 with a significant drop. The Sultanate of Oman and Bahrain will also experience higher economic growth than in 2023 and will probably experience growth of 2.7% and 3.3% respectively in 2024.

Persistence of Dutch disease among Persian Gulf Cooperation Council countries

Statistical facts indicate that the member states of the Persian Gulf Cooperation Council still have a long way to go to achieve the economic goals listed in the vision documents. In 2022, due to the significant increase in the price of oil and the increase in demand in the market, the Arab countries were able to earn an acceptable income. But in 2023, due to the decrease in energy prices, the decrease in the demand for buying crude oil and the recession prevailing in the global economy, the countries of the region could not earn an acceptable income.

Now, based on the forecast made by the World Bank, it seems that with the improvement of the global economic indicators and the increase in the demand for buying oil, we should probably expect an increase in the price of oil. The increase in the price of this strategic material will mean a positive trend in the growth rate of the oil-rich countries of the Persian Gulf. The continuation of this trend means that in the short term, the oil-rich countries of the region are still dependent on the ups and downs of the energy market and cannot formulate their long-term policies without considering the continuation of dependence on the oil and gas market.