Pak Sahafat – The website of the Bloomberg news network predicted in an analysis that despite the apparent improvement in the American economic situation, which is similar to the calm before the storm, 6 factors will play a role in the country’s return to recession.

According to Pak Sahafat News Agency the website of this economic network wrote on Monday: Although the inflation rate was decreasing this summer, the employment rate was high and consumer confidence has increased, but contemporary history teaches us that the current situation is the calm before the storm.

In the continuation of this report, Bloomberg listed 6 determining factors in the downward course of the American economy and its future recession:

Strike in the automobile industry: For the first time, the workers of three major American automobile companies are on strike at the same time, and about 25,000 workers refuse to attend the factories. The industry’s extensive supply chain means that a production stoppage can have far-reaching consequences. In 1998, a 54-day strike by 9,200 General Motors workers cut 150,000 jobs across the United States.

Read more:

The excuse of the US Congress to save the Biden administration from the “suspension” scandal

Student loans: Millions of Americans will resume paying student loan installments this month after a 3-and-a-half-year hiatus during the Corona pandemic. The resumption of these payments could reduce 0.2 to 0.3 percent of annual economic growth in the fourth quarter of 2023.

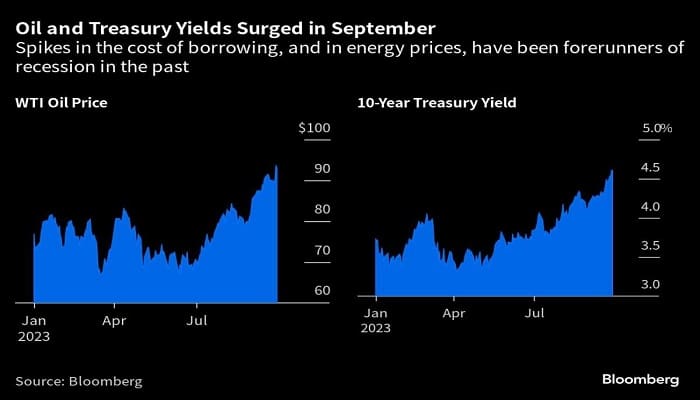

Rising oil prices: Rising oil prices, which affect the income and expenses of all families, are one of the few truly reliable indicators of impending recession. Crude oil is now traded 25 dollars above its price floor in the summer season and has reached more than 95 dollars per barrel.

Treasury bonds: The red-hot stock market made the interest rate of 10-year Treasury bonds reach the highest level in the last 16 years, i.e. 4.6%, in September. The increase in the interest rate of long-term bonds has caused the stock markets to decline. This phenomenon can endanger the revival of the housing market and discourage companies from investing.

Global Recession: The world around America can also drag this country down. The world’s second largest economy (China) is engulfed in the real estate crisis, and in the Eurozone, the lending process is lagging behind the government debt crisis, which will be a sign of the downward trend of the European economy.

Government Shutdown: The Congress deal postponed the threat of a government shutdown by 45 days, moving it from October to November. A possible government shutdown at that time could end up hurting GDP more in the fourth quarter. Bloomberg estimates that each week of the shutdown will reduce annual GDP growth by about 0.2 percent, with most, if not all, of that loss offset after the government reopens.